Creating the Ultimate Finance Tracker

Welcome to XL Intelligence, we understand the pivotal role that finance tracking plays in the success of small businesses. Today, we'll delve into the significance of having a small business finance tracker, guide you through the process of creating one in Excel, and introduce you to the world of Excel dashboard creation. By the end of this article, you'll be equipped with the knowledge and tools to streamline your financial management, and we invite you to reach out for a dashboard consultation to supercharge your business's financial health.

Why You Need a Small Business Finance Tracker

Running a small business can be a formidable challenge, and one of the primary obstacles many business owners face is managing their finances effectively. Without a robust finance tracker, businesses often struggle with disorganised records, inaccurate financial data, and an inability to make data-driven decisions. Here's why a small business finance tracker is essential:

Clarity and Transparency: A finance tracker provides a clear and transparent view of your financial data. It allows you to track your income, expenses, and cash flow in real-time, ensuring you always have a pulse on your business's financial health.

Efficiency: Manual record-keeping can be time-consuming and prone to errors. With a finance tracker, you can automate repetitive financial tasks, such as data entry and calculations, saving valuable time.

Cost Control: By meticulously tracking expenses, you can identify areas where you can cut costs and optimise your spending, ultimately improving your bottom line.

Forecasting: Historical financial data is a treasure trove for predicting future trends and planning for your business's growth. A finance tracker enables you to create accurate forecasts and set achievable goals.

Compliance: Small businesses are subject to tax regulations and financial reporting standards. A well-structured finance tracker helps you ensure compliance and simplifies the tax-filing process.

Now, let's move on to the steps of creating your own small business finance tracker in Excel.

Creating Your Small Business Finance Tracker in Excel

Excel is a versatile and widely used tool that can transform your financial management. Here's a step-by-step guide to help you build your finance tracker:

Open Excel and Select a Template: To start, open Excel, and select an appropriate template for your small business finance tracker. You can find ready-made templates or create a custom one tailored to your specific needs.

Set Up Your Tracker: Begin by entering your business's financial data, including your income, expenses, and other relevant financial information. It's crucial to be consistent in your data entry.

Customise the Dashboard: Excel allows for extensive customisation. You can add or remove fields, categories, and labels based on your business requirements. This step is essential to ensure that the tracker meets your specific needs.

Automation: Leverage Excel's powerful formulas and functions to automate calculations. This not only saves time but also reduces the risk of errors in your financial data.

Generate Reports: Use Excel to create various reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports provide insights into your business's financial performance.

Data Visualisation: Excel offers built-in charts and graphs that can help you visualise your financial data. Creating visual representations of your data makes it easier to interpret and communicate financial information effectively.

Regular Updates: To maintain accurate financial records, update your finance tracker consistently. Set aside dedicated time for this task to ensure you stay on top of your financial health.

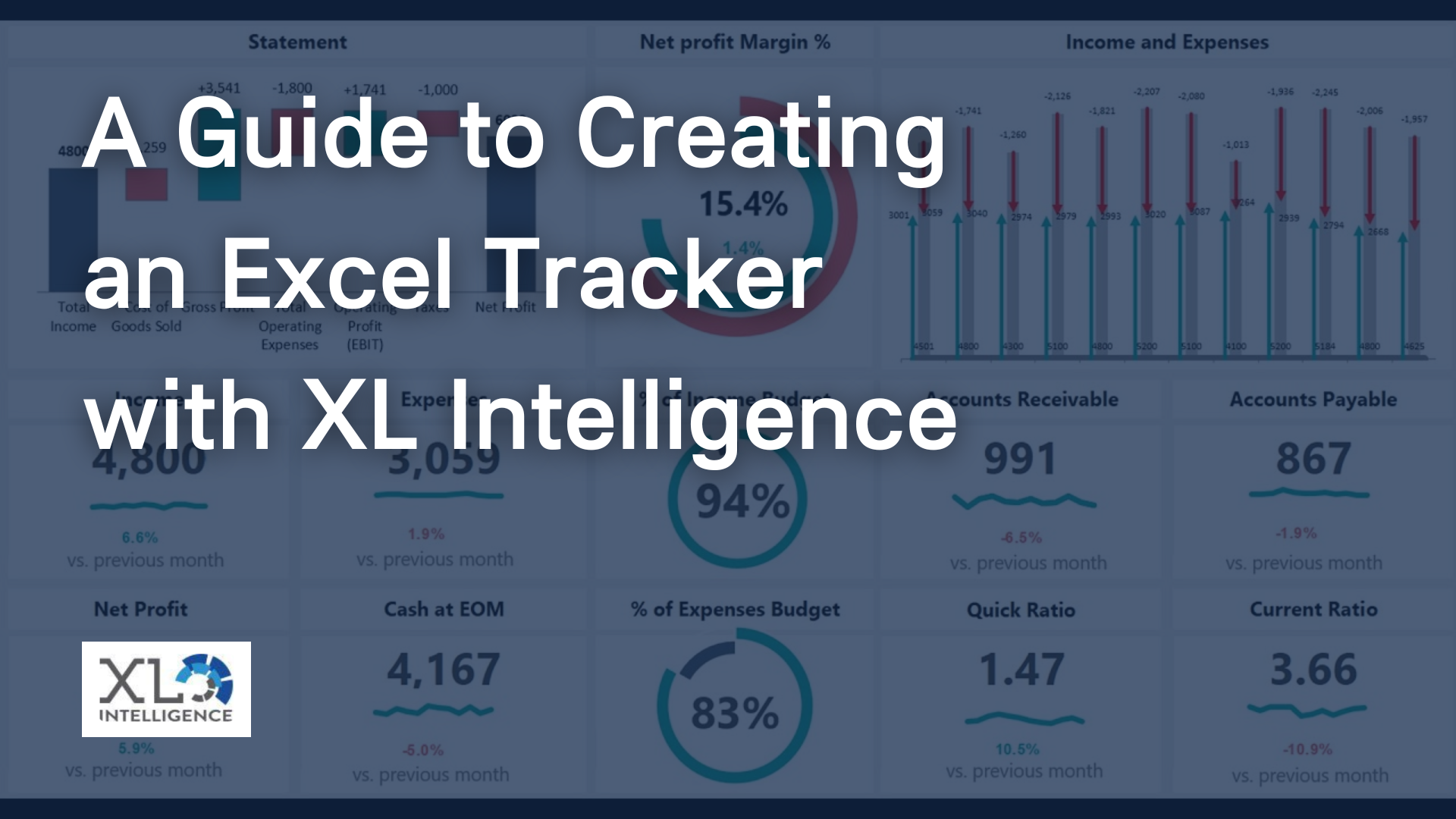

Building an Excel Dashboard for Your Finance Tracker

Once you have set up your small business finance tracker in Excel, the next step is to create a dashboard to display the most critical information at a glance. An Excel dashboard can help you monitor your finances in a user-friendly way. Here are some tips for building an effective dashboard:

Choose Key Metrics: Select the most important financial metrics you want to track on your dashboard. This could include revenue, expenses, cash flow, and profitability.

Use Visual Elements: Incorporate charts, graphs, and visual indicators to make your dashboard visually appealing and easy to understand.

Interactive Features: Add interactive features such as drop-down menus and slicers to allow for easy data exploration and analysis.

Customisation: Customise your dashboard to fit your business's branding and style. This makes it more visually appealing and aligned with your business identity.

Regular Update: Ensure that your dashboard is updated in real-time or at regular intervals to reflect the most current financial data.

Conclusion

A small business finance tracker is your compass to navigate the complex financial landscape of entrepreneurship. By creating one in Excel and complementing it with a dashboard, you can streamline your financial management, improve decision-making, and achieve better control over your business's finances.

At XL Intelligence, we understand the importance of an effective finance tracker. If you're ready to take your small business's financial management to the next level, we invite you to contact us for a dashboard consultation. Our experts will help you create a custom Excel dashboard that caters to your specific business needs and empowers you to make data-driven decisions. Don't wait; take the first step towards financial success today.

Contact us to book your consultation and unlock the full potential of your small business's finances.

Get in Touch

We will get back to you as soon as possible.

Please try again later.

We specialise in Advanced Excel training, Dashboard development, Data Analysis, Power BI and VBA. We also provide training with, both standard and customised courses to suit your organisation’s needs.

Quick Links

Address

2, 26 Linden Gardens London W2 4ES

Phone

07737 707 548

by SEO Local Services | All Rights Reserved | XLIntelligence